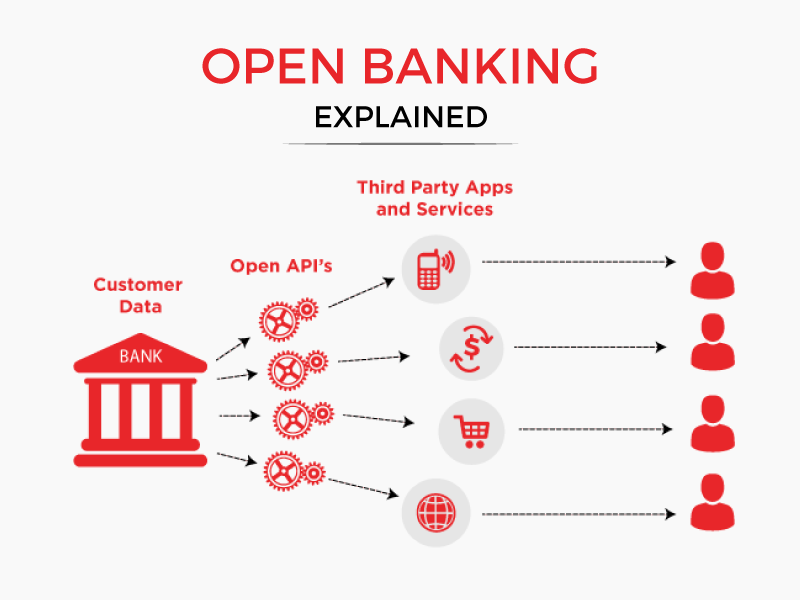

What is Open Banking Open Banking is a new way for you to use financial products and services. Through Open Banking you can give providers…

Secured vs. Unsecured loans One of the simplest ways to distinguish between business finance products is to see whether or not the lending is secured. You’ll often…

Compare Business Loans Many businesses considering finance want to compare business loans to see what’s available to them. There are lots of ways to do this, which…

Learn How to Finance Business Growth There are countless possibilities for business growth, and using business finance can help your plans have more impact. Below…

Plan the Growth of Your Small Business using Financial Aid Using finance to aid growth can be smart and potentially explosive, and there are many…

Follow these 6 Golden Rules of Managing Cash Flow Managing cash flow is a crucial part of running a business, to make sure you have…

Tips to avoid rejection of your business loan application Availing a Business Loan can be a life-changing decision. Whether it is for travel, to deal…

These 5 Steps Will Help you Apply for a Business Loan Successfully The process of applying for a small business loan is not a complicated procedure, provided…

A Comprehensive Guide for Business Loan – Know Before You Apply If you’re considering a business loan, there are a lot of things you need to…

Lending to small and medium-sized enterprises forms the core of the Financial institution’s financing business. However, due to the complex and often delayed credit-seeking procedures,…